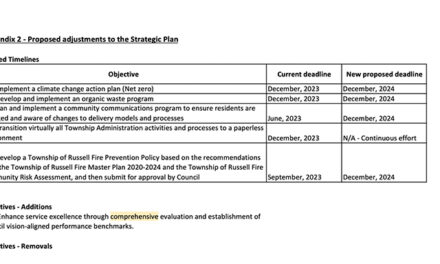

The Centre J. Urgel Forget in Embrun has been welcoming retirees since1986. The retirement home offers a variety of services and activities for everyone. Courtesy Photo

RUSSELL – A request for a break in their property tax rate from the Centre J. Urgel Forget in Embrun has been turned down by the Russell Township Council.

The decision is based on the fact that the municipality does not have the authority to consider this kind of property tax request.

The request asked the council to change property tax classification for the centre from multi-residential to residential. The residential property tax is lower than the multi-residential tax.

Russell chief administrative officer Dan Faughnan introduced a report about the request.

On Jan. 20, the mayor and council members received a letter from the Centre J. Urgel Forget with a request that their property be charged the residential tax rate rather than the multi-residential tax rate.

“This request was discussed briefly during the Jan. 30 council meeting, and council requested that the administration investigate as to whether council even has the authority to provide such a credit. Council voiced certain concerns about the precedent that would be set, if such a request was approved and about the possibility of other owners of multi-residential property making similar requests and the difficulties it could generate in being fair and equitable with all taxpayers.”

After research into the idea of changing a property tax classification with treasurer of the United Counties of Prescott, and Russell and municipal tax consultants, Russell staff was informed they did not have the authority to make such a change for one organization or property.

“Tax classes are established by MPAC and the township’s tax invoicing must follow these classifications. Also, providing a grant or credit to commercial or industrial businesses would contravene restrictions as set out in section 106 of the Municipal Act on municipal bonusing. The only possible option of granting a credit to the Centre Urgel Forget would seemingly be through a Municipal Capital Facility Agreement, under section 110 of the Municipal Act, between the Centre Urgel Forget and the United Counties of Prescott and Russell. Such an agreement also seems unlikely as there are a set number of requirements to meet in respect to the UCPR’s housing policies to be eligible.”

Russell Mayor Pierre Leroux said, “They are like many not for profit corporations that are struggling financially a little bit. They were looking for some kind of tax break, but unfortunately the way the municipal act is written, such options as far as tax relief goes are not available.”

He added that at the county level you can play with tax rates but that is across the board, not for one specific property.

“When they built the newer part of their building five or six years ago. the law had just changed. The older multi-residential residences are paying a certain rate and the newer ones are paying the same as the residential rate,” he said.

“At the counties, the rate for multi-residential is 2.0 per cent and the residential rate is 1.0 per cent, so it is basically double but we have been lowering that every year at the county level. So hopefully in a few years everybody will be the same. They were asking for their particular property but we have to do things across the board not for just one property.”

Joseph Morin is the Editor of the Eastern Ontario AgriNews, and the Record. He is, despite years of practice, determined to eventually play the guitar properly. He has served the Eastern Ontario community as a news editor, and journalist for the past 25 years with the Iroquois Chieftain, Kemptville Advance, West Carleton Review, and Ottawa Carleton Review in Manotick. He has never met a book he did not like.